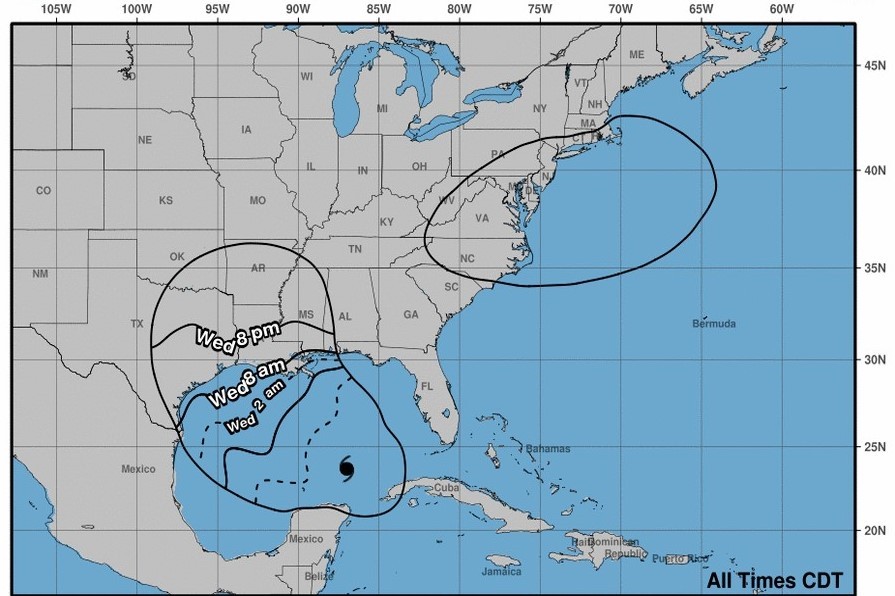

Hurricane Laura is churning across the Gulf of Mexico and has set her eye on Houston, Galveston, and the Texas Gulf Coast.

Hurricane Laura Could Make Landfall as Category 3 Storm

The storm could make landfall as early as Wednesday night, likely as a Category 3 hurricane.

Laura shifted slightly west last night, placing her on a collision course with the Northwest Gulf Coast. The storm strengthened to hurricane-status around 7:15 a.m. today, when it was nearly 150 miles northwest of Cuba. Sustained winds were last recorded at 75 mph.

“The overnight trends with Laura are not good, and everyone in the greater Houston and Galveston metro area needs to be making final preparations for a potential hurricane landfall,” Eric Berger of Space City Weather wrote early Tuesday according to The Houston Chronicle.

If the storm does strengthen to Category 3, those in its path should prepare for sustained wind speeds of 115 mph.

Mandatory Evacuation Orders for Galveston, Parts of Harris County

Tropical storm conditions will likely begin menacing the area by Wednesday afternoon.

The next two days could see life-threatening storm surges from San Luis Pass to Ocean Springs, Mississippi. The threat of widespread flash flooding from eastern Texas to Louisiana to Arkansas will increase tomorrow.

“Best case, it’s a really close call for our area,” Jeff Evans, a National Weather Service Houston/Galveston forecaster, told the Chronicle. “Worst case, we have the worst storm we’ve had in decades around here.”

At 6:00 a.m. today, a mandatory evacuation order went into effect for the City of Galveston. Residents have been directed to secure loose items on their property and leave the island with all family members and pets.

“Mandatory evacuations will be ongoing throughout the day and early tomorrow, so people have time to secure their properties, businesses, etc. and leave for safety,” Galveston officials said in a statement. “Residents are NOT required to be off the island by 12 p.m. City services will be suspended at 12 p.m. People should be getting their plans together this morning for an evacuation.”

Judge Lina Hidalgo has also ordered mandatory evacuations for parts of Harris County.

Hurricane Laura Insurance Claims

Hurricane Laura could bring widespread flooding and damaging winds reminiscent of Hurricane Harvey to some areas. Once the storm passes, potentially millions of property owners along the Texas Gulf Coast will begin the process of filing claims with their insurance companies.

While a minority of insurance carriers will eventually pay their policyholders the full repair or replacement value, most, unfortunately, will delay, deny, or underpay. To protect your rights, our Houston Hurricane Damage Lawyers have created a general overview of the information and documentation that you’ll need when initiating your claim and proving your damages.

Determine if Your Insurance Policy Covers Flood Damage

Many homeowners wrongly assume that flood coverage is included with their homeowner’s insurance policy. But you’re only covered for flooding if you purchased a separate insurance policy from the National Flood Insurance Program (“NFIP”), which is backed by the Federal Emergency Management Agency (“FEMA”)

File Your Insurance Claims Right Away

The hours and days following a major storm or hurricane are often overwhelming, especially for those who’ve sustained significant property damage. Nevertheless, it’s crucial that your file a property damage claim with your insurance company immediately.

If you have flood insurance, you should also be sure to file a flood claim with the insurance company that sold you that policy. You can get additional information on how to file the claim from FEMA’s website by clicking here.

Document All Property Damage

Once it’s safe to return to your property, take time to document all damages via video or photographs.

You should also take notes describing the damage, the cost of the damaged property, and when the property was purchased. Try to obtain credit card receipts and any other documents that prove your claim. Before turning your photos, video, and documentation over to the insurance company, be sure to make copies for your records.

Don’t throw away any damaged property until it’s been inspected by the insurance adjuster, as you could be denied payment if the adjuster is unable to inspect the property. Also, make sure that you are present for every moment of the inspection and make sure the adjuster performs a comprehensive inspection. In cases of widespread damage and flooding, insurance adjusters will have many inspections scheduled and may try to speed the process along. Don’t let yourself feel rushed.

Take the adjuster through your entire property, even areas where there is no visible damage. Sometimes, the adjuster’s inspection will detect damage that isn’t readily apparent.

Expect the adjuster to ask you questions about your home’s condition before Hurricane Laura, and be sure to provide comprehensive and accurate information. However, because you’re not an expert, make sure to tell the adjuster there may be damage that you haven’t noticed.

Document the Claims Process

Throughout the claims process, you’ll need to document and save all communications with your insurance company and its claims adjuster, as this information will prove crucial if a dispute arises. If you speak to the insurer by phone, follow up with an email or some other written record of who you spoke with and the nature and date of the conversation.

File your Proof of Loss Form within 60 Days

If you’re filing a flood insurance claim, your adjuster might provide you with a “Proof of Loss” form. Otherwise, you can obtain the form online at FEMA’s website. You MUST file this form within 60 days of the flood event unless FEMA grants an extension. Failure to timely file the Proof of Loss form may result in a denial of your claim.

This form is your statement of the amount of money you are requesting as a result of the flood damage, and it must include documentation, such as receipts or credit card statements, to support the value of the damaged items. A comprehensive overview of the information required in a Proof of Loss statement may be found on FEMA’s website.

However, you should not sign the Proof of Loss form if you don’t agree with the insurance company’s appraisal. In the event you disagree, consider hiring a third-party contractor to provide an estimate of the cost to fix or replace your property. Compare the estimate from the contractor and the insurance company. Again, all of these steps must be taken within 60 days of the flood.

Contact our Experienced Hurricane Damage Lawyers at 1-888-984-1391 or Clicking Here

If your insurance company delays, denies, or underpays your Hurricane Laura claim, it’s vital to have an Experienced Hurricane and Flood Damage Lawyer on your side.

Our Houston-based attorney will answer your questions, explain your rights, and provide all the information you need to decide what’s best for you and your family.

Call 1-888-603-3636 or click here to send us a confidential email through our contact form.

All consultations are free and, since we work exclusively on a contingency fee basis, you won’t have to pay us a dime unless we recover damages from your insurance company.